August 16, 2017 – Within the broader Park City market area, a changing geographic trend continues

August 16, 2017 – Within the broader Park City market area, a changing geographic trend continues

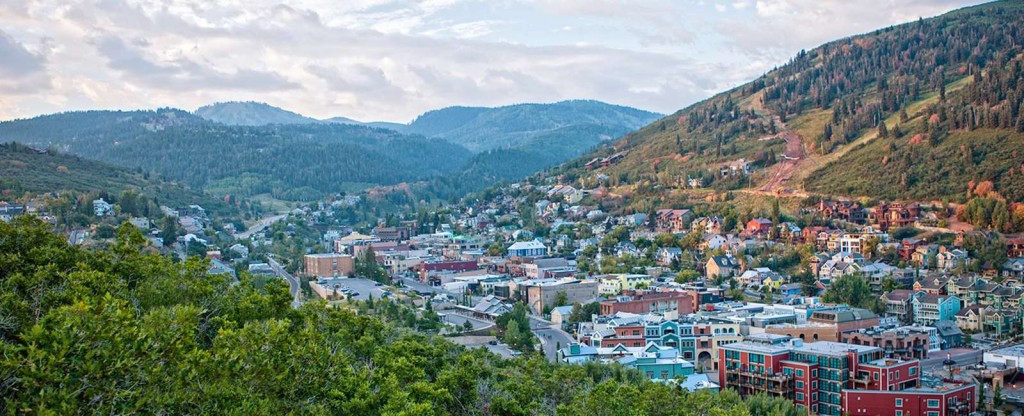

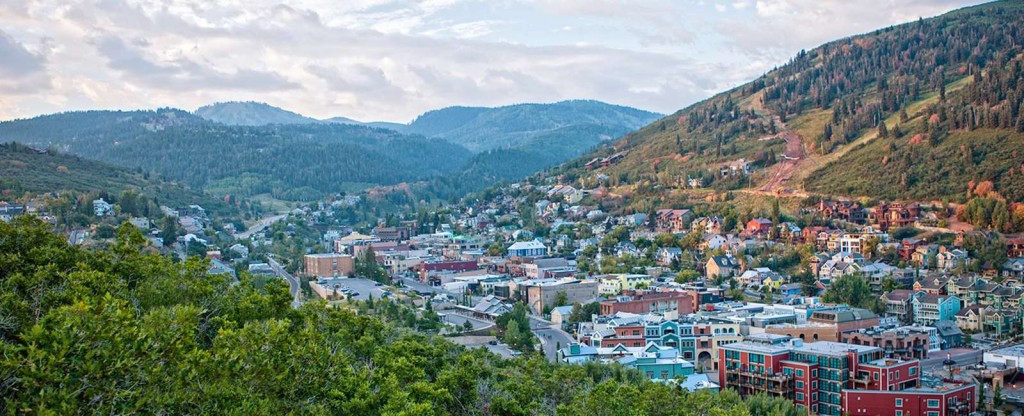

At the close of the second quarter year-over-year housing statistics released by the Park City Board of REALTORS® show steady market growth and absorption of inventory in Summit and Wasatch Counties. With a unique mix of primary, secondary and investment property owners, the broader Park City market area is composed of numerous diverse micro-markets. Price-sensitive buyers looking for value are becoming more enticed by neighborhoods outside Park City than in the past; while properties in certain neighborhoods within the City Limits and the Snyderville Basin are being renovated to address design changes towards more contemporary layouts.

Year-Over-Year Single Family Home Sales

For our entire market area, the number of single family home sales was up 13% over the previous 12 months, the total dollar volume was up 16%, and the median sold price of $690,000 was up 4%.

With 374 closed sales, the Snyderville Basin surpassed all other areas and experienced more than double the total number of sales within the City Limits; while the median price in the Basin climbed 5% over the previous year to $970,000, it rose 20% within the City Limits reaching $1.9 M. With the growing number of second-home buyers who are willing to pay a higher price for new construction or recently renovated properties, there has been an upward tic in price for sought after locations.

Snyderville Basin

- Over the last 12 months the neighborhood with the highest number of closed sales in the Basin was Promontory with a median price of $1.72 M. Offering new product and amenity-rich lifestyle, buyers have been drawn to the new design and multi-season services found in neighboring gated communities.

- Jeremy Ranch had a median price of $925,000 and a total of 53 closed sales.

- Pinebrook saw a 23% increase in median price to $922,000 and 48 closed sales.

- Consistently low on inventory, Silver Springs had a median price flat to last year’s number at $938,000, with five fewer sales.

Park City Limits

- Park Meadows saw a 23% increase in median price with $1.84 M and 44 closed sales – up 13% to the previous 12 months.

- Old Town experienced an 11% median price increase to $1.49 M but a 16% decrease in number of sales.

- The median sales price in Prospector was slightly up reaching $825,000, with 10 closed transactions.

- Combined there were only 13 home sales in Empire Pass and Upper Deer Valley. Both neighborhoods saw median price decreases as well, with Empire at $5.66 M and Upper DV at $5.85 M.

- Lower Deer Valley saw a burst of activity with nine more closed sales than the previous 12 months and held a stable median price of $2.1 M.

Jordanelle, Heber and Kamas Valleys

- Driven by new construction in Victory Ranch, the Jordanelle area was up 28% in median price to $1.52 M.

- Heber / Daniel had 203 closed sales for the year with a slight increase in median price to $360,000.

- Midway, consistently reporting the highest median sold price in the Heber Valley, did so again at $469,000.

- Quantity sold increased 24% in the Kamas Valley – and median sold price also significantly increased over the previous 12 months:

- Woodland / Francis had a median price of $457,000 with 30 transactions.

- Kamas / Marion had a median price of $312,000 with 34 transactions.

- Oakley had a median price of $397,000 with 48 transactions.

Year-Over-Year Condominium Sales

For our total market area, the total number of closed sales was up 6%, total dollar volume was up 28%, and median sold price increased 12% to $500,000. The 333 condo sales within the City Limits surpassed the Snyderville Basin’s number of 310, and with new product available, the Jordanelle area saw a steep 39% increase in the quantity sold reaching 191.

Snyderville Basin / Jordanelle

- The Canyons neighborhood averaged 10 sales per month with a total of 113 for the year – the highest in the Basin, with a 14% median price increase to $635,000.

- The Kimball area had a steady 80 transactions with a median price of $335,000.

- Pinebrook was on par to last year’s number of 61 closed sales sustaining a median price of $463,000.

City Limits

- Old Town accounted for the highest number of condo sales with 133 (28 more than last year) and ended the quarter with a median price of $565,000.

- Upper Deer Valley shot up in quantity sold, with 31 more sales than last year – the lion’s share of which can be attributed to Stein Eriksen Residences. The median price also increased to $2.6 M.

- Activity in Park Meadows picked up due to larger unit sales in sub-divisions like Last Sun and Four Lakes, with a 31% increase in the quantity sold and a noticeable 56% price increase to $932,000.

- Prospector’s median price of $136,000 remained stable to last year’s number.

Looking Forward

Sara Werbelow, President of the Park City Board of REALTORS® commented, “It’s important to pay attention to the micro-market areas that tell their own story; however, in general supply is continuing to pace with demand in our greater market area.” Since zip codes don’t explain neighborhood individuality, property condition, or amenities; and neighborhoods vary greatly in both price and inventory levels, buyers and sellers are encouraged to contact a member of the Park City Board of REALTORS® to find answers to specific real estate related inquiries.